Condo Insurance in and around Laredo

Laredo! Look no further for condo insurance

Cover your home, wisely

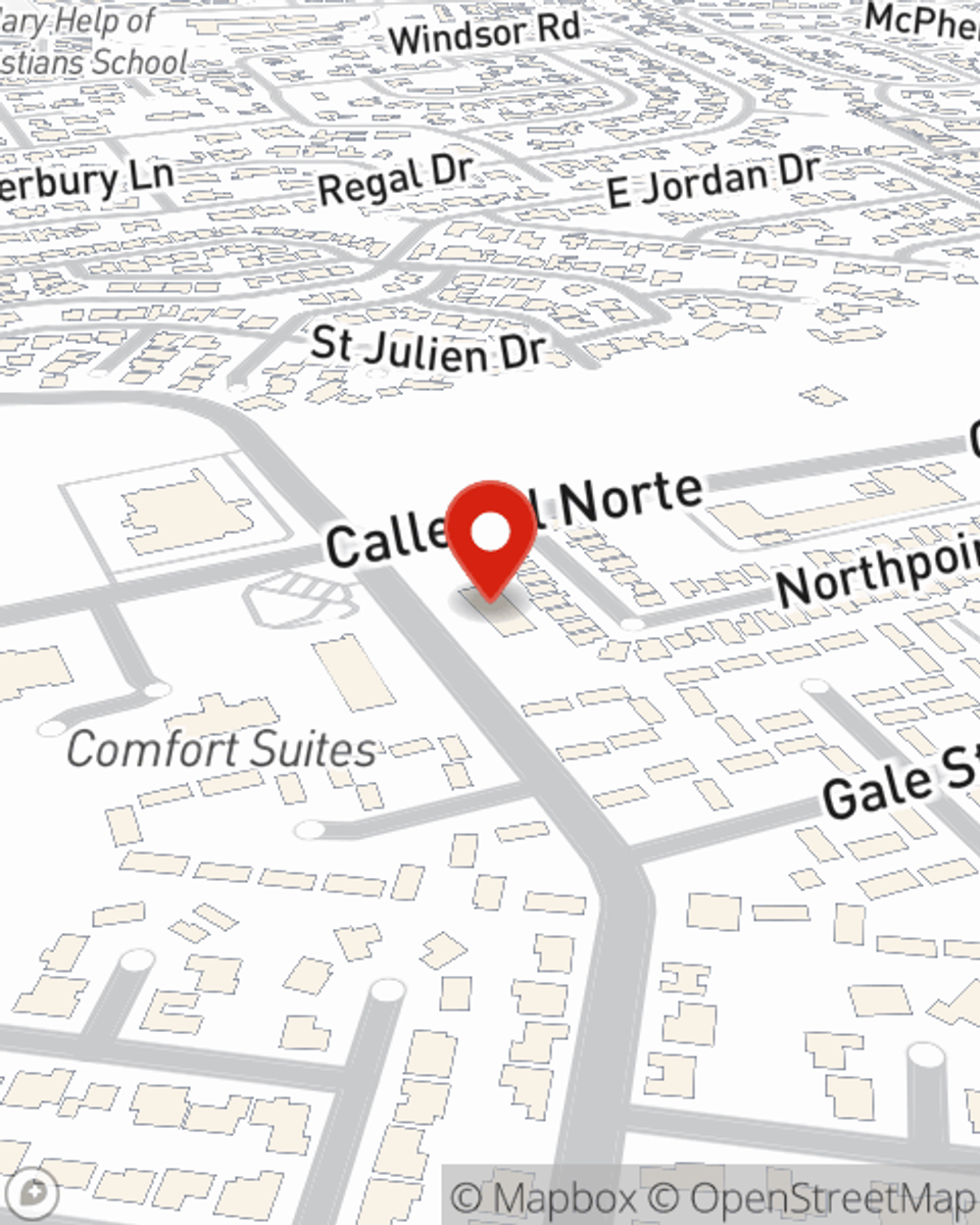

- Laredo

- Webb County

Home Is Where Your Heart Is

Because your unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to vandalism or weight of snow. That's why State Farm offers coverage options that may be able to help protect your condo and its contents.

Laredo! Look no further for condo insurance

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Anabella Herbig is ready to help you navigate life’s troubles with dependable coverage for all your condo insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Anabella Herbig can help you submit your claim. Keep your condo sweet condo with State Farm!

As one of the top providers of condo unitowners insurance, State Farm has you covered. Reach out to agent Anabella Herbig today to learn more.

Have More Questions About Condo Unitowners Insurance?

Call Anabella at (956) 725-1617 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Anabella Herbig

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.